2025 is true across the nook, making it the right time to replicate in your monetary journey in 2024 and the place you wish to be subsequent yr and past.

Whereas a part of that reflection can embrace hopes and goals, it is also necessary to establish some errors to keep away from subsequent yr to be able to keep on observe to hit your monetary planning objectives.

Picture supply: Getty Photos.

The pitfalls of sector rotations

One of many worst strikes an investor could make is leaping out of an organization or sector simply because it’s underperforming within the brief time period and placing that cash into a warmer sector. There are numerous examples of the place this technique fails and results in missed alternatives. However maybe essentially the most potent is 2022, when a number of mega cap progress shares acquired hammered as a consequence of valuation issues, inflation, and slowing progress.

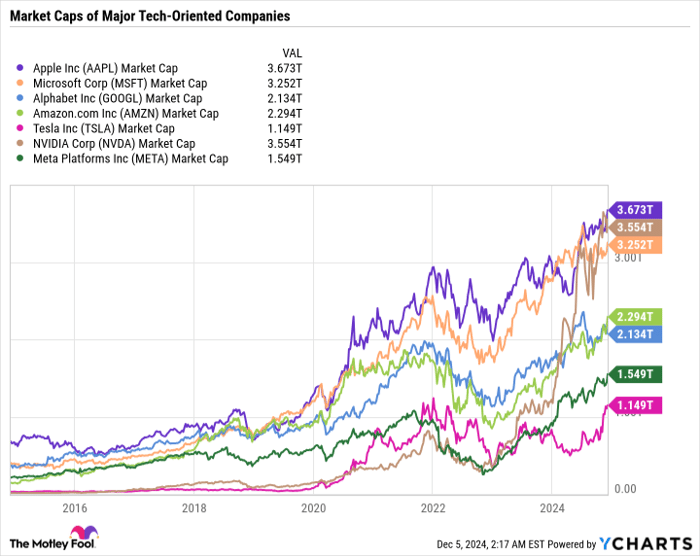

On the finish of 2022, the mixed market capitalization of Apple, Microsoft, Alphabet, Amazon, Tesla, Nvidia, and Meta Platforms was $6.9 trillion. Lower than two years later, the mixed market cap of those self same seven firms is $17.6 trillion. Traders who panic-sold out of progress shares simply because they have been out of favor would have missed a historic rally.

AAPL Market Cap knowledge by YCharts

Different noteworthy examples embrace promoting out of oil and gasoline shares throughout the downturn of 2020. Within the final 4 years, the power sector is up 129%. Or promoting out of the monetary sector in 2023 within the wake of the banking disaster that noticed some small to mid-size banks fail. To date this yr, financials are the best-performing sector — outperforming tech and plenty of growth-focused ETFs.

The important thing takeaway is that the market strikes in cycles. Sectors and themes can go out and in of favor for numerous cheap or foolish causes. However clean out the pattern over time, and high quality firms with earnings progress are inclined to win out in the long run.

Managing momentum

Constructing upon the final level, one other mistake value avoiding is overhauling your funding technique primarily based on short-term momentum drivers. If you’re unfamiliar with cryptocurrency, it will be a nasty concept to purchase Bitcoin simply because it’s up a lot in a brief interval. However if you happen to did analysis and found that you simply wish to personal Bitcoin long-term, that is a unique case.

One other instance can be piling into scorching tech shares simply because they’re going up with out doing analysis. That being stated, there are legitimate causes to spend money on synthetic intelligence themes. For instance, seeing Nvidia proceed to carry off the competitors and maintain its ultra-high margins is extremely encouraging. Equally, we’re seeing enterprise software program firms like Salesforce that had been lagging the sector efficiently monetize AI and escape to new highs.

The AI-driven rally is basically primarily based on current earnings progress — not potential progress. Nonetheless, you do not wish to dive headfirst into red-hot AI shares simply because they’re going up, however relatively take the time to analysis the trade and discover the businesses you have got essentially the most conviction in and can be prepared to carry by means of intervals of volatility.

Be proactive, not reactive

Annually brings a brand new set of expectations, challenges, and fears. It is easy to get caught up and develop recency bias primarily based on components that appear to hold essentially the most affect in a second. Whereas it is important to pay attention to these components and the way they will affect the businesses you’re invested in, it may be an enormous mistake to overreact to those components.

For instance, the brand new administration will convey coverage adjustments that can possible affect company taxes, commerce coverage, power coverage, renewable power tax credit, and extra. Proper now, there is no such thing as a scarcity of media dedicated to speculating what the brand new administration will do, and that hypothesis can collide with markets to spur some extremely unstable value motion in numerous belongings.

Making massive adjustments to your portfolio primarily based on near-term guesses is not a good suggestion. A greater train can be to take a look at the businesses you’re invested in and guarantee they will do nicely it doesn’t matter what administration is in cost. In different phrases, have they got the flexibility to endure challenges and even take market share throughout an industrywide downturn, or may their financials be squeezed or possibly even compromised? And if that’s the case, is that threat already baked into the value and one thing you are prepared to simply accept?

Errors occur on a regular basis

Each investor makes errors. And the longer you journey in your funding journey, likelihood is you may construct up your justifiable share of regrets, however hopefully additionally a constant course of for aligning your investments together with your monetary objectives.

Now is a good time to take a deep breath and establish some errors you might be susceptible to creating to stop them earlier than they happen.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $872,947!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of December 2, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Bitcoin, Meta Platforms, Microsoft, Nvidia, Salesforce, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.