Washington County, WI – Property tax payments for Washington County, Wi can be found to verify on-line. Some throughout the county are receiving them within the mail. How did your 2024 assertion look?

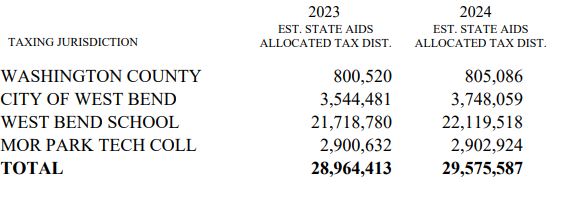

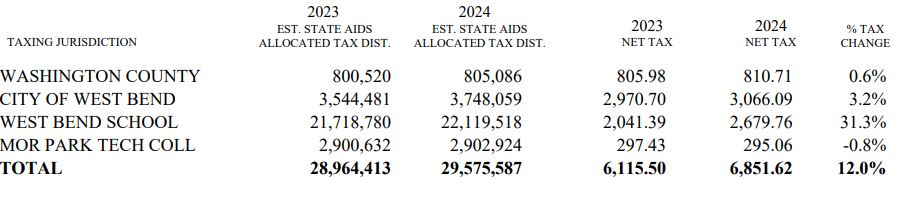

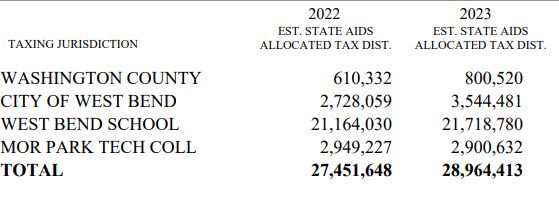

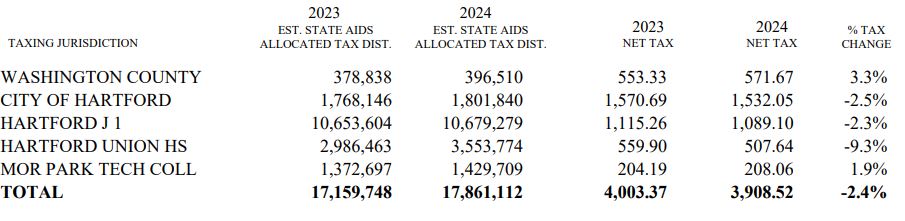

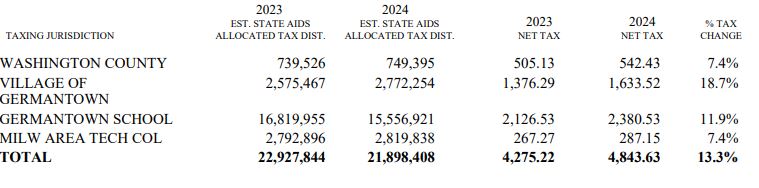

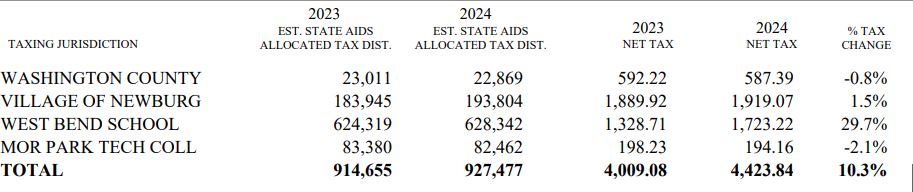

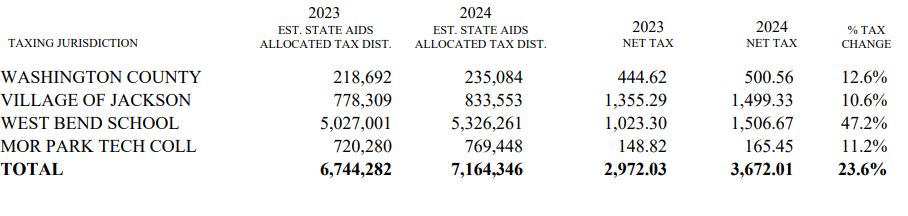

Beneath are a handful of tax statements from cities, cities, villages in Washington County.

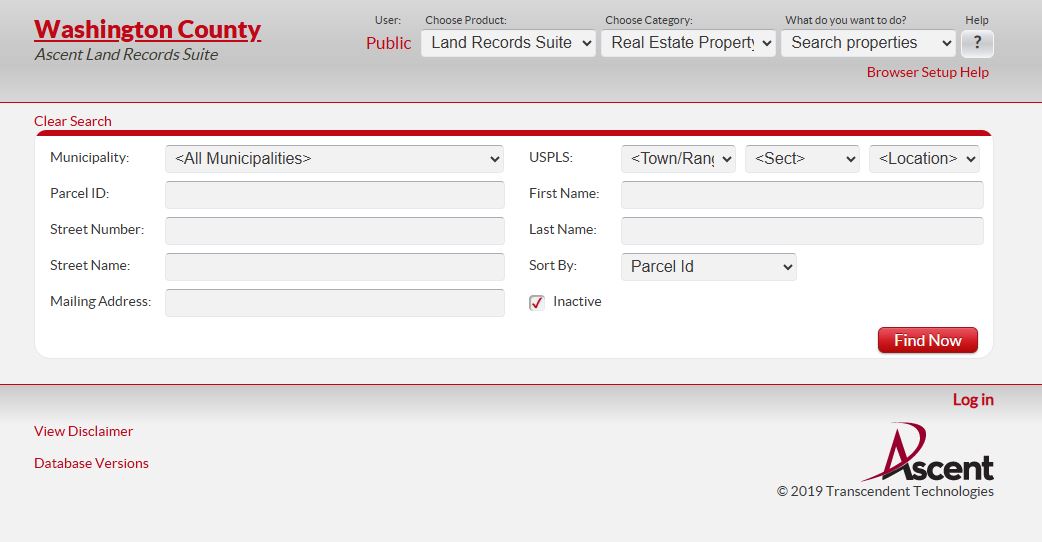

The County Treasurer net web page has the most recent tax data out there at Pay Taxes On-line to view your assertion.

Kind in your final identify or just the deal with quantity. Much less data is greatest.

Click on HERE to SUBSCRIBE to

FREE native information at

Washington County Insider on YouTube

Then click on the pink ‘FIND NOW’ button within the decrease proper, click on the pink parcel quantity after which beneath the pink bar that reads TAXES, go to ‘print tax invoice’ and click on 2024 and your full assertion ought to present.

Most communities in Washington County, WI have statements now out there on-line. As of Saturday night time, December 7, 2024, there have been nonetheless no statements for the Villages of Slinger and Kewaskum.

How did your taxes find yourself… in comparison with final yr??

Info:

– The West Bend College District $165 million referendum had a serious influence on property tax will increase together with +31.3% in West Bend, +32.9% in City of Trenton, +47.1% in City of Jackson, +47.2% in Village of Jackson

On a historical past observe: Hartford, WI had a revaluation in 2022, West Bend and the Village of Kewaskum had revaluations in 2023, City of West Bend had a revaluation in 2024.

It is a working story, and extra data will probably be posted when particulars can be found.

Associated

Work or the content material on WashingtonCountyInsider.com can’t be downloaded, printed, or copied. The work or content material on WashingtonCountyInsider.com prohibits the tip consumer to obtain, print, or in any other case distribute copies.